What is taken into consideration complete coverage insurance policy to one vehicle driver may not be the same as even another vehicle driver in the very same house (low cost auto). Preferably, complete coverage means you have insurance in the kinds and quantities that are proper for your revenue, possessions and run the risk of account.

Rates also vary by hundreds and even thousands of bucks from company to company. That's why we constantly suggest, as your primary step to saving cash, that you compare quotes. Below's a state-by-state comparison of the average annual price of the following coverage degrees: State-mandated minimum obligation, or, bare-bones insurance coverage required to lawfully drive a vehicle, Full protection responsibility of $100,000 per individual injured in a mishap you cause, up to $300,000 per crash, and also $100,000 for home damage you create (100/300/100), with a $500 insurance deductible for thorough as well as collision, You'll see just how much full insurance coverage vehicle insurance costs monthly, as well as yearly.

perks credit auto cheaper auto insurance

perks credit auto cheaper auto insurance

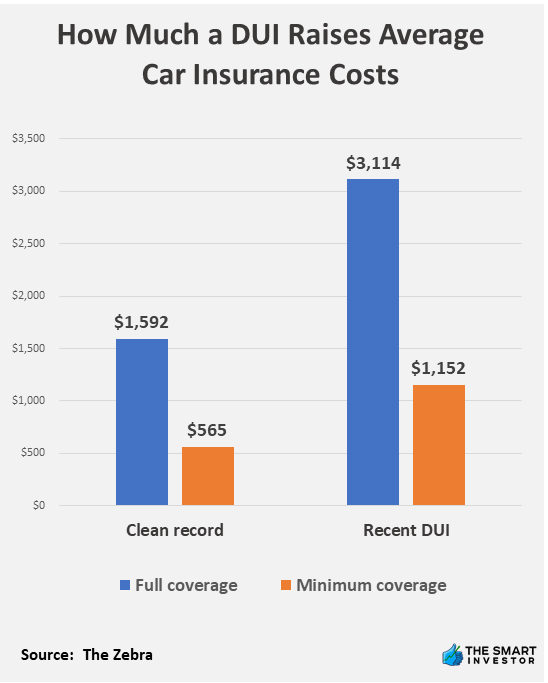

The average annual rate for full coverage with higher liability restrictions of 100/300/100 is around $1,150 more than a bare minimum policy. If you select reduced obligation restrictions, such as 50/100/50, you can save yet still have respectable security. The ordinary month-to-month cost to improve coverage from state minimum to full insurance coverage (with 100/300/100 restrictions) is regarding $97, but in some states it's a lot less, in others you'll pay even more (cheap).

Your car, up to its reasonable market value, minus your insurance deductible, if you are at mistake or the other chauffeur does not have insurance coverage or if it is ruined by an all-natural catastrophe or taken (compensation as well as collision)Your injuries and of your passengers, if you are hit by an uninsured driver, up to the limitations of your without insurance vehicle driver policy (uninsured driver or UM).

Examine This Report about How Much Does Car Insurance Cost On Average? - The Zebra

accident cheapest car insurance insurers cheapest car

accident cheapest car insurance insurers cheapest car

Complete protection automobile insurance plans have exclusions to specific events. Each complete cover insurance policy will certainly have a list of exclusions, suggesting items it will not cover. Racing or various other rate competitions, Off-road use, Use in a car-sharing program, Disasters such as war or nuclear contamination, Destruction or confiscation by federal government or civil authorities, Using your car for livery or shipment functions; company usage, Deliberate damage, Cold, Wear as well as tear, Mechanical breakdown (frequently an optional protection)Tire damage, Things swiped from the cars and truck (those may be covered by your house owners or tenants plan, if you have one)A rental cars and truck while your very own is being repaired (an optional coverage)Electronic devices that aren't completely connected, Custom-made parts and equipment (some little quantity may be defined in the plan, however you can generally add a rider for higher amounts)Do I require full protection automobile insurance coverage? You're called for to have responsibility insurance policy or some other proof of monetary duty in every state.

You, as an automobile owner, get on the hook directly for any kind of injury or building damages beyond the limits you selected. Your insurance provider will not pay greater than your restriction. Responsibility insurance coverage won't pay to repair or replace your car. If you owe cash on your automobile, your lending institution will require that you acquire collision and thorough coverage to secure its investment. prices.

Below are some general rules on guaranteeing any type of cars and truck: When the car is brand-new and also funded, you need to have complete coverage. Maintain your deductible workable. When the automobile is repaid, raise your insurance deductible to match your readily available cost savings. (Greater deductibles help lower your premium)When you get to a factor monetarily where you can replace your car without the support of insurance, seriously consider dropping comprehensive and collision.

com's on the internet car insurance coverage calculator to get our suggestion of what cars and truck insurance coverage you should get. It'll also recommend deductible restrictions or if you require coverage for without insurance motorist protection, medpay/PIP, and umbrella insurance coverage. How to obtain low-cost complete coverage vehicle insurance? The most effective method to locate the cheapest complete protection car insurance is to shop your protection with various insurers.

More About How Many Us Drivers Don't Understand Their Policies?

Here are a few tips to follow when looking for low-cost complete protection vehicle insurance: Make sure you are regular when shopping your liability limitations. If you choose in physical injury responsibility each, in bodily injury liability per crash as well as in building damage liability per crash, constantly go shopping the exact same insurance coverage degrees with other insurance providers (insure).

prices cheap auto insurance cars cheapest car insurance

prices cheap auto insurance cars cheapest car insurance

These protections belong to a full coverage plan, so a costs quote will certainly be needed for these insurance coverages as well. Both crash and also thorough featured a deductible, so be certain constantly to choose the same insurance deductible when looking for insurance coverage. Picking a higher insurance deductible will press your premium lower, while a reduced insurance deductible will cause a greater costs - auto insurance.

There are other coverages that assist comprise a complete coverage bundle - low cost. These protections vary yet can include: Uninsured/underinsured driver insurance coverage, Injury defense, Rental compensation insurance coverage, Towing, Gap insurance coverage, If you require any one of these added coverages, constantly pick the very same coverage levels as well as deductibles (if they apply), so you are comparing apples to apples when looking for a new Additional reading plan - risks.

Can I drop complete coverage auto insurance coverage? Examining our data, we discovered that about of vehicle drivers who own a lorry at the very least 10-years old are acquiring extensive and also crash protection - cheaper. Various other vehicle drivers may think about dropping these optional coverages as their vehicle nears completion of its life. If you can handle such a loss-- that is, change a taken or completed car without a payment from insurance coverage-- do the mathematics on the prospective cost savings and also think about going down insurance coverages that no longer make feeling.

The Best Guide To Average Cost Of Car Insurance - Creditdonkey

Dropping detailed and accident, she would pay regarding a year a financial savings of a year. Allow's state her auto is worth as the "actual cash money worth" an insurer would certainly pay. If her car were amounted to tomorrow and she still lugged full protection, she would certainly get a look for the cars and truck's actual cash money value minus her insurance deductible.

Certainly, the vehicle's value goes down with each passing year, therefore do the insurance coverage costs. At a particular point, most drivers would certainly select to accept the threat and financial institution the collision and also detailed premiums due to the fact that they would be not likely to locate a trusted substitute with the insurance payout. Complete insurance coverage cars and truck insurance policy frequently asked question's, Just how much is complete insurance coverage insurance policy on a brand-new cars and truck? There is no particular response to this concern as premiums can differ significantly relying on your personal factors, where you live as well as the sort of cars and truck you are driving (auto).

cheaper car cheaper car auto cheap car insurance

cheaper car cheaper car auto cheap car insurance

Maine has the least expensive complete auto insurance coverage rate on the various other end of the range, with a typical premium of a year. How much is complete coverage insurance for 6 months?

If you are financing your lorry, your insurance firm will likely require that you bring minimal full insurance coverage for financed cars and truck to protect their investment in your lorry. Suppose you aren't carrying comprehensive or collision insurance coverage and your lorry is damaged in an accident by an extreme weather event or various other risk.

Average Cost Of Car Insurance In The U.s. For 2022 - Us News - Questions

The term "full insurance coverage" just refers to a collection of insurance policy coverages that offer a large selection of defenses, basically, shielding your vehicle in "complete."While "complete insurance coverage" can suggest various things to various people, most drivers take into consideration full insurance coverage automobile insurance coverage to include not just necessary state protections, such as obligation insurance policy yet comprehensive and collision insurance coverages.

That has the most inexpensive complete insurance coverage cars and truck insurance? There is no real means to identify that has the most inexpensive full coverage auto insurance coverage as insurance policy premiums can vary significantly also within the very same area. Insurance companies take into consideration a broad selection of elements when setting a costs, as well as several of those elements are personal, so rates can differ significantly between chauffeurs.

Constantly see to it you are contrasting apples to apples when it comes to protection levels and also deductibles. cheaper.

Michigan's statewide ordinary $2,535 per year still clocked in much greater than the nationwide average of $1,483 each year, as well as with approximately $5,072 annually, Detroit still uploaded the highest possible average car insurance policy prices in the U.S (insurance company).The average annual price for drivers in the Grand Rapids metro location was $2,349, The Zebra analysis found - vans.

Get This Report on Carshield Review: Cost, Coverage & More (April 2022)

Prior to July 2020, all Michigan drivers had to have unlimited accident defense (PIP) insurance coverage on their insurance coverage. On all policies issued or restored after that, chauffeurs have actually had the option to select a various degree of insurance coverage or opt-out entirely if their health and wellness insurance covers auto-related injuries.

Other vehicle drivers can pick to maintain endless PIP insurance coverage or select protection strategies covering out at $500,000, $250,000 or $50,000 for Medicaid recipients. One prompt saving for vehicle drivers originated from a reduction in the expense of the Michigan Catastrophic Claims Organization charge. If motorists do not go with limitless PIP protection, they don't need to pay a charge at all.